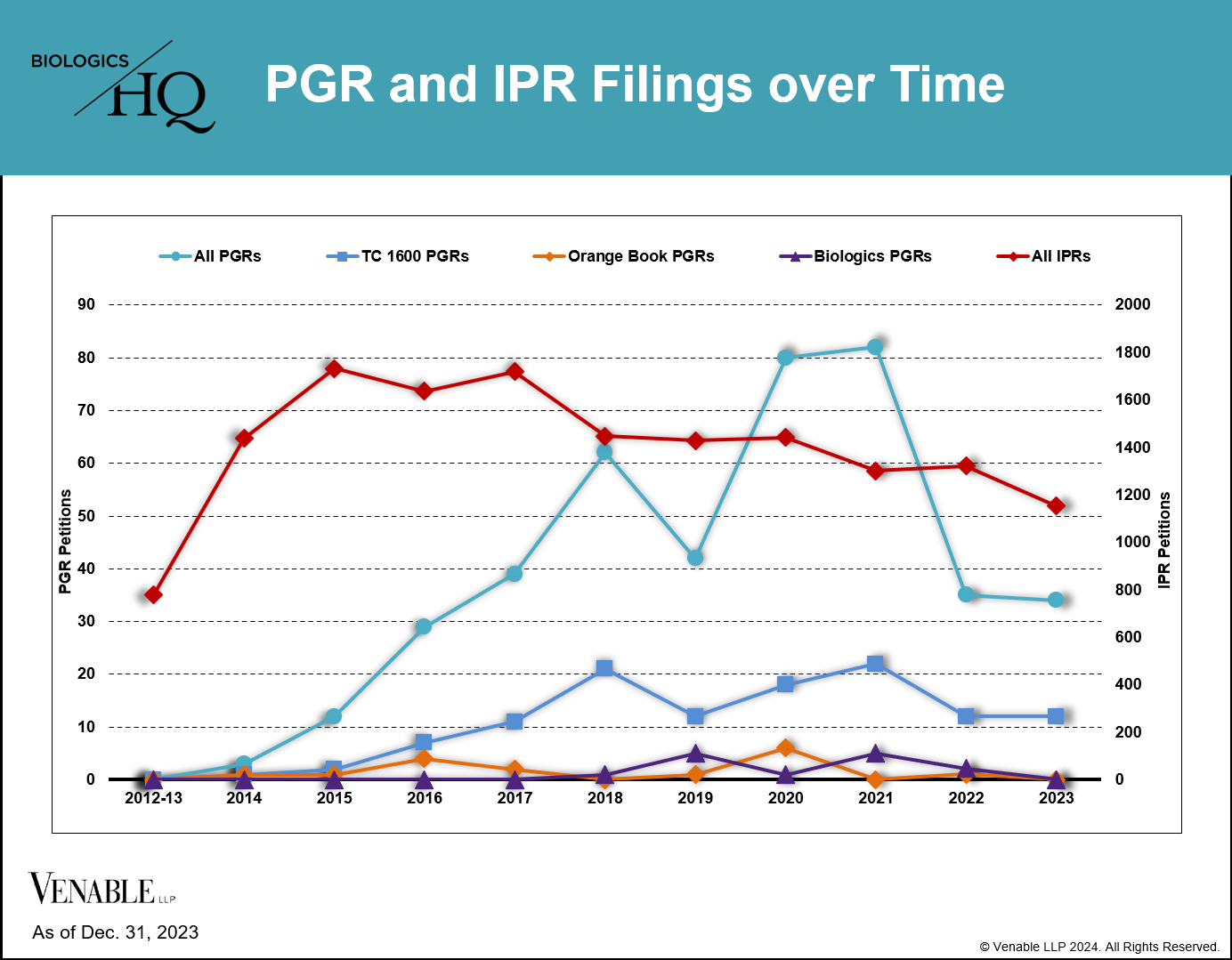

This figure shows the number of PGR and IPR petitions filed since their inception in 2012 through December 31, 2023. For our analysis, we reviewed PGR filings for all patent technologies (teal line) as well as the subsets of PGRs filed on Orange Book-listed patents (orange line), CDER-listed biologic drug patents (“Biologics”) (purple line), and TC 1600 patents (blue line).

BiologicsHQ and materials published on BiologicsHQ are published for informational purposes only. Neither the information nor any opinion expressed on BiologicsHQ constitute legal advice, create an attorney-client relationship, or constitute a solicitation for business.