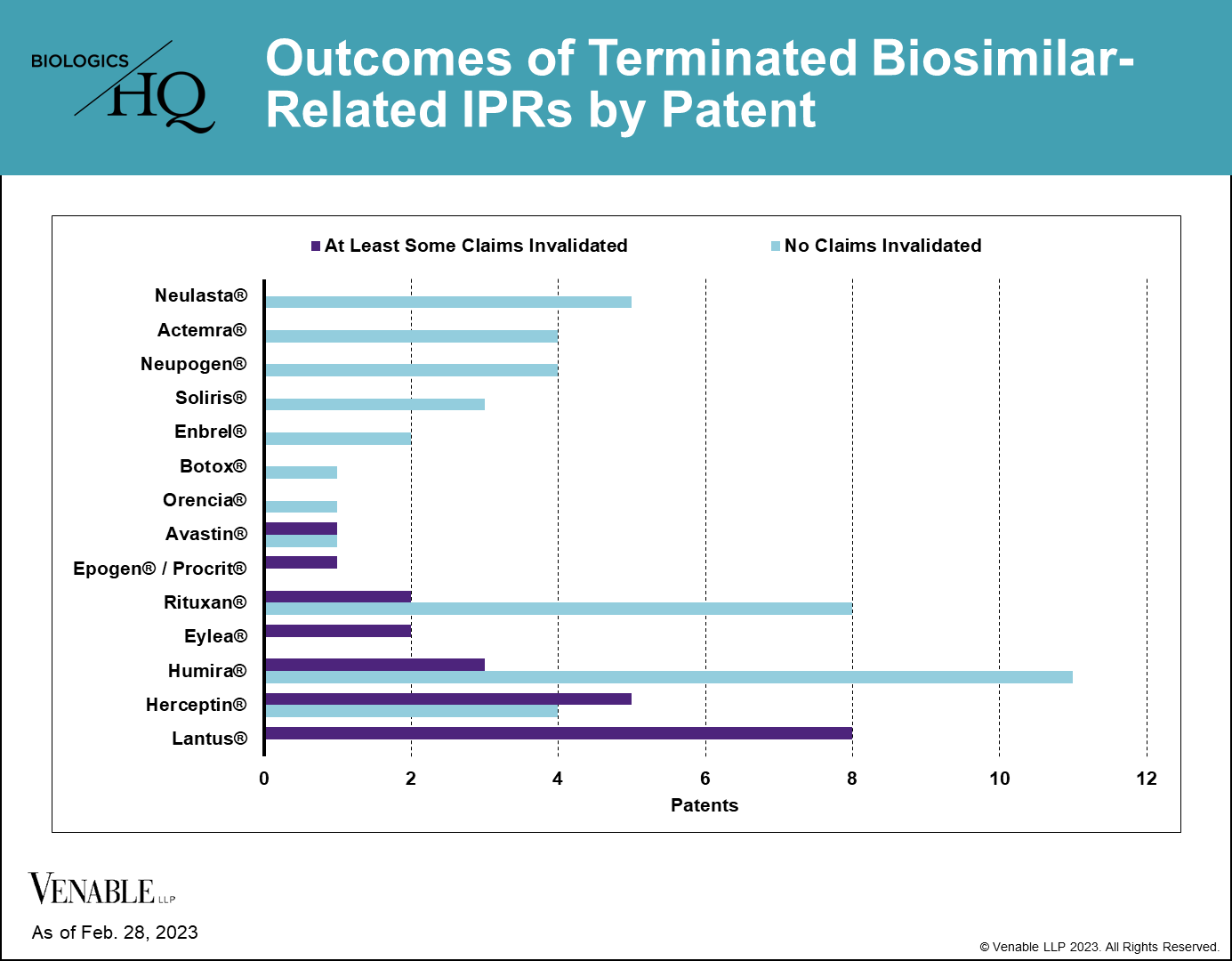

*Outcomes of terminated biosimilar-related IPRs by patent. Patents with no claims invalidated include those that were not instituted, as well as those with IPRs that were terminated without a final written decision. Patents with at least some claims invalidated include patents where claims were disclaimed by the Patent Owner, and patents where some or all of the challenged claims were invalidated in a FWD. Appeal decisions were considered in the outcomes listed.

Despite some reference products having 20 or more IPRs, we found that few patents have ultimately been invalidated covering any individual reference product. Half (7 of 14) of the reference products having patents challenged in IPRs have not lost a single patent claim. For most biologics that lost patents in IPRs, only 1-5 patents were lost from their estates. For Lantus® (insulin glargine) four patents were invalidated in their entirety and some claims were invalidated in four additional patents (three of the four lost all of the claims challenged in IPRs, but maintained the claims that were not challenged).

Although losing patents in IPRs can potentially be damaging to maintaining a reference product’s market exclusivity, most biologics are covered by multiple patents and are retaining some patent coverage after IPR decisions.

For biosimilars, filing an early IPR petition could result in a settlement with a known launch date early on in development. These early settlements can provide certainty to the innovator and the biosimilar and avoid the expense of a large litigation. So far, RPSs have generally waited to see if an IPR will be instituted prior to settling, with four IPRs settled prior to institution and 20 settled after.

BiologicsHQ and materials published on BiologicsHQ are published for informational purposes only. Neither the information nor any opinion expressed on BiologicsHQ constitute legal advice, create an attorney-client relationship, or constitute a solicitation for business.